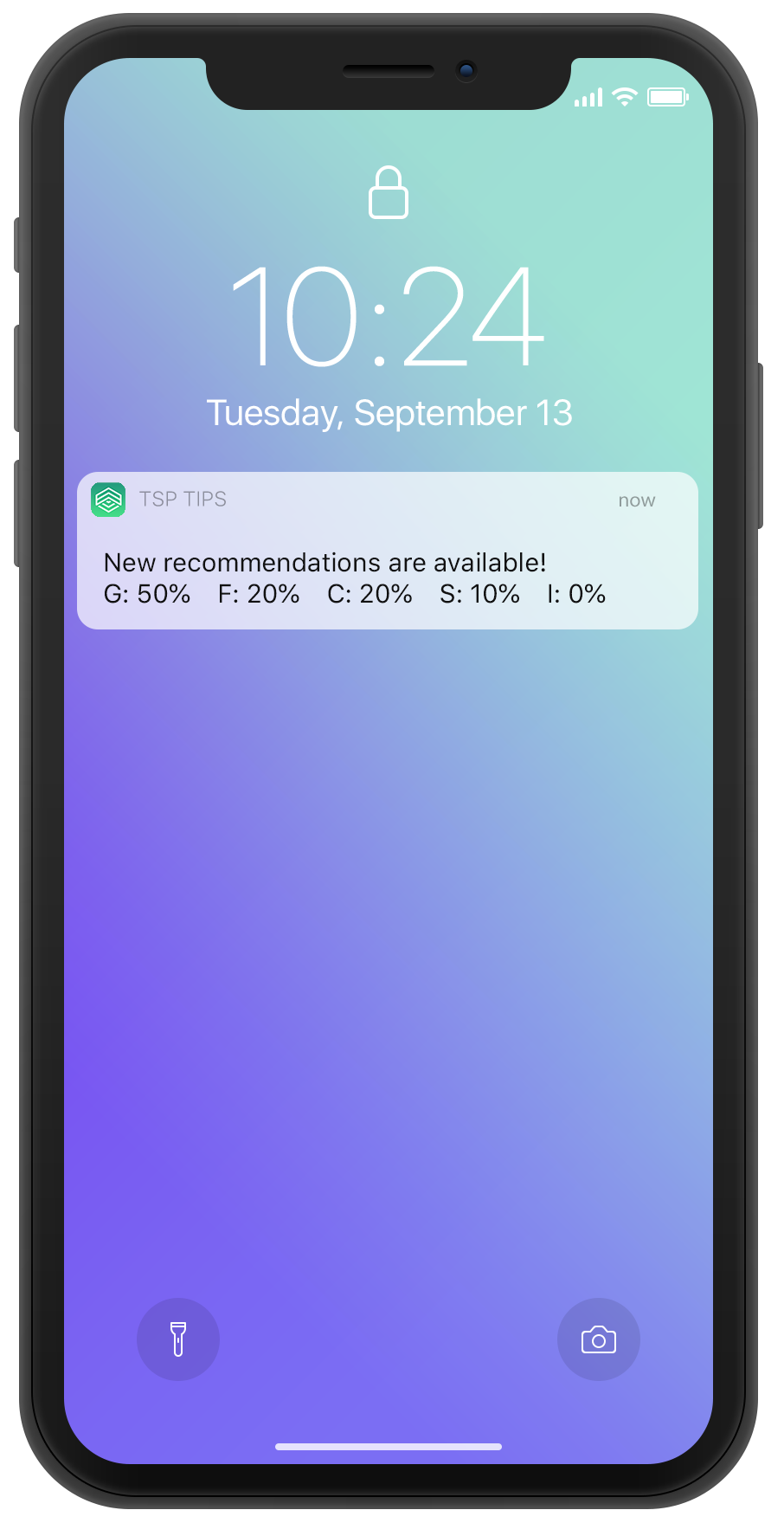

Pro TSP recommendations.

For your chosen risk profile.

Right to your phone.

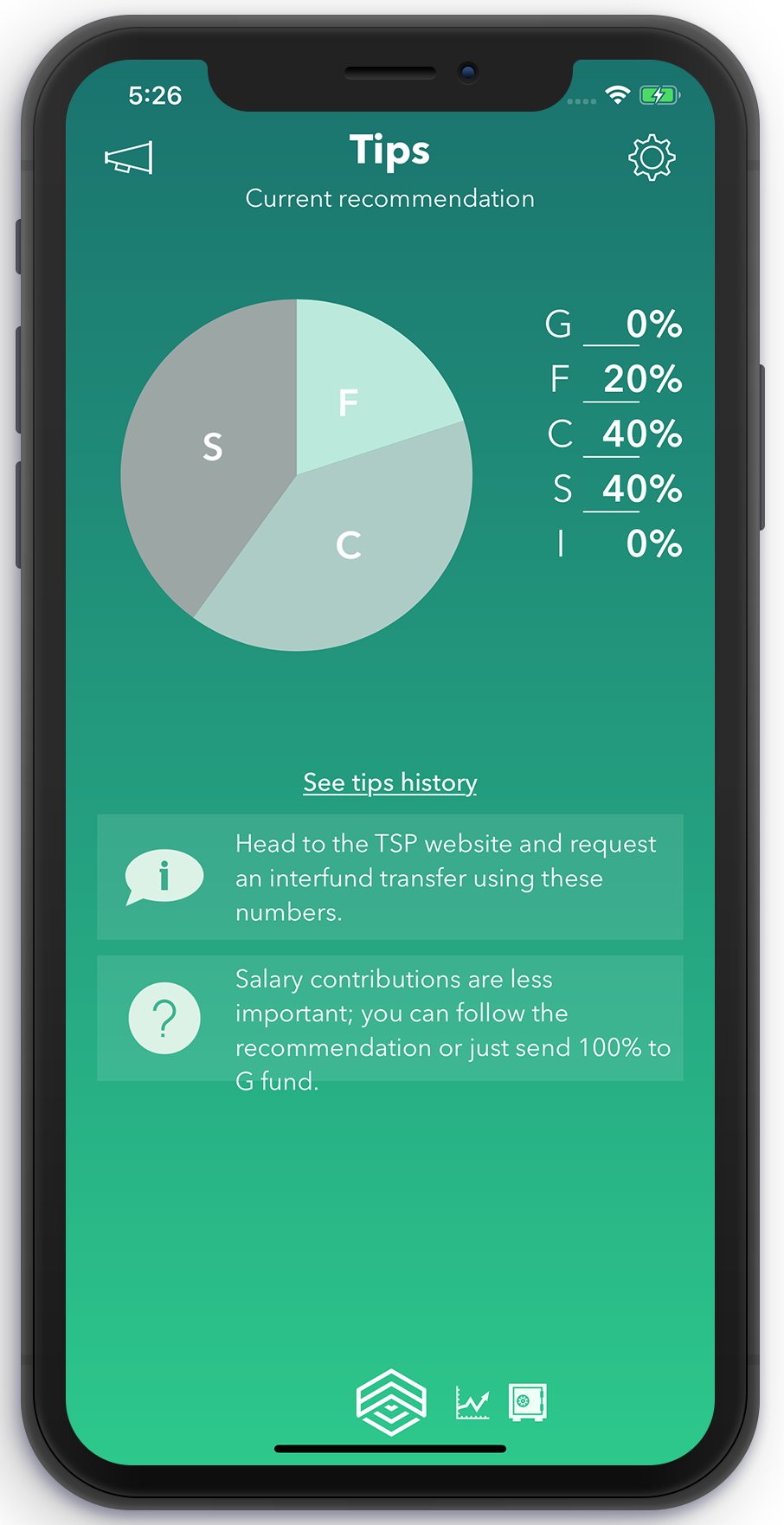

We send tips. You move your funds. That's all there is to it.

Get started

We send tips. You move your funds. That's all there is to it.

Invest your retirement with the peace of mind that comes with PhD credentials and CFP certification, a TSP strategy with a proven track record, and over 30 years of research and experience. Whether you're a conservative investor, aggressive, or somewhere in between.

Try it free for 30 days, no strings attached. After that, it's $8 a month, or less if you subscribe annually.

We send recommendations on where to put your money, and you move it.

And that's it.

Our investment strategy is the product of 30+ years of market research and data analysis. You wouldn't trust your retirement to a gut feeling, and neither do we.

All we need to send you TIPS is your email address. No other personal info. You can keep that account number to yourself.

We'll send you recommendations when you need to move your funds, and nuggets of finance-related wisdom when you don't.

We'll keep you up to date on what's going on with the markets, and leave you better informed for those Monday morning water cooler conversations.

The S&P 500 had an up week and month, as it closed Friday at 6939, at the same point it was two weeks ago. Monday was anticipation day as the markets rose slightly ahead of earnings reports by Apple, Meta and Microsoft. Tuesday was more of the same but on Wednesday the S&P 500 briefly topped the 7,000 threshold, but ultimately ended the day little changed after the Fed kept its benchmark interest rate at a range of 3.5% to 3.75%. On Thursday those earnings reports did not move the markets as the S&P 500 posted a second consecutive losing session, but trimmed declines after President Trump nominated Kevin Warsh to succeed Jerome Powell as Federal Reserve chair. And then came Silver sell off Friday. Silver still tallied a ninth straight monthly rise, its longest such win streak on record, but Fridays plunge was the metal's worst daily drop since 1980. The Silver ETF (SLV) closed Thursday at $105.57, opened Friday at $89.33, and closed at $75.44 for a daily loss of 28.54% (Ouch!!). From a technical perspective the January Barometer, and its associated saying: "As goes January, so goes the year." was positive with a monthly rise of 1.37%. Since 1945, whenever the S&P 500 has ended January with gains, the market on average increased 16.2% that year. For next week Alphabet and Amazons reports earnings on Wednesday and Thursday, followed by Januarys payrolls and unemployment numbers on Friday. For TSP TIPS the I fund remains at the top of the Performance Ranking leaderboard with new record highs on Monday, Tuesday and Friday. The C and S funds are in a tight battle for the runner up position and we may see a breakout next week. As such we recommend no changes to our current investment mixes.

Our strategies focus on avoiding large losses (like 2008) while still reaping the benefits when markets are thriving (like 2013).

We can't win all the time. No one can. But rest assured that our TIPS are based 100% on strategy and mathematics, and not emotions.

Start an annual subscription to our tips, and start with a 30-day trial, free. Gratis. On the house.

If it's not for you, cancel anytime in those 30 days at no charge.

Professional investment guidance for federal employees and military personnel.

Questions? Email us at contact@tsptips.com